To the Future of Light

INTRODUCTION

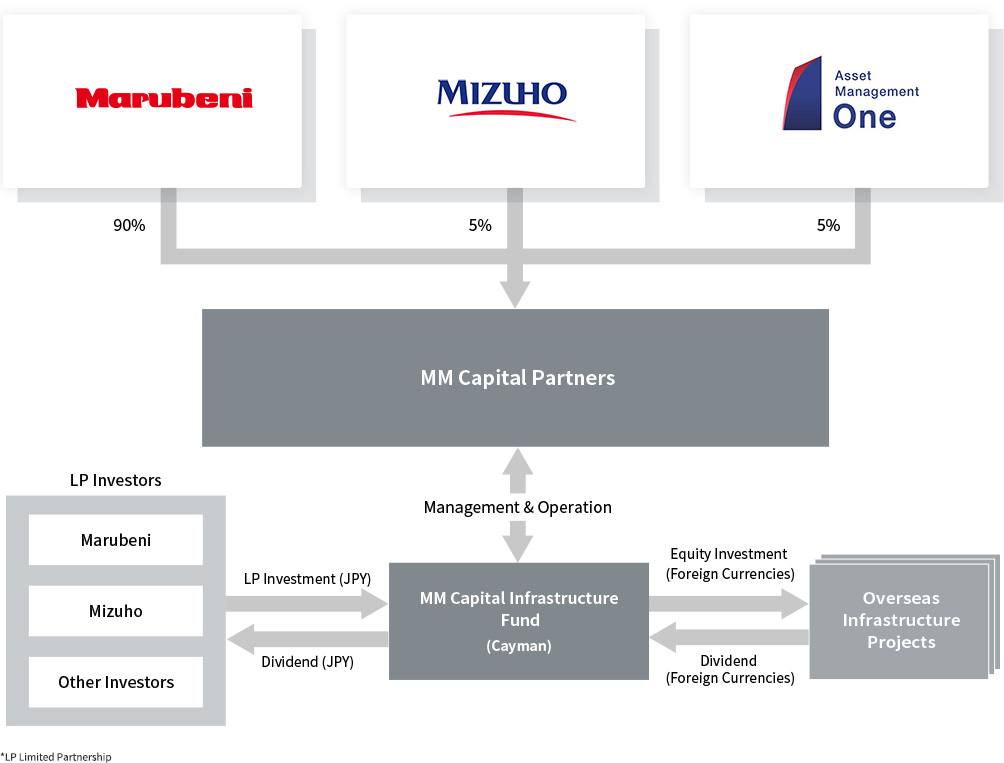

MM Capital Partners was formed by our sponsor shareholders Marubeni Corporation, Mizuho Bank, and Asset Management One. The mission of our infrastructure fund, that we have established and manage, is to offer our investors access to opportunities to invest in high quality international infrastructure assets. We are committed to managing the fund in a manner that fully utilises the experienced local teams, complimented by global networks and expertise that our sponsors have accumulated through their global infrastructure businesses, fund management and investments.

At MM Capital Partners, we aim to realise a better society and brighter future through our participation in the global infrastructure market.

Investment Strategy

MM Capital Infrastructure Fund, which is MM Capital Partners' fund, will be managed according to the following investment strategies.

Category

Our focus is on Core infrastructure assets that generate a stable cashflow, supported by incorporating Core+ or Value-up type assets into the portfolio where appropriate.

Sector

Our infrastructure fund was established with Marubeni as a sponsor. We intend to utilise the market knowledge, local industry networks, and investment skills that Marubeni has accumulated over decades in order to mitigate risks and maximize the fund's return.

Stage

Some of the major risks facing infrastructure projects are encountered during the project’s construction phase. In order to eliminate these kinds of risks, our fund only invests in brownfield assets, i.e. projects for which construction has been completed and commercial operation commenced with earnings being generated.

Geography

Project risk is mitigated and stable returns achieved by investing in projects located in OECD member countries, where the political landscape is stable and the legal frameworks are well established.

PORTFOLIO

NEWS

To Our Stakeholders

MM Capital Partners was established in 2018 by Marubeni Corporation, Mizuho Bank, Ltd. and Asset Management One Co., Ltd. with the purpose of operating and managing specialized funds for equity investments in infrastructure assets located in OECD Countries.

The global infrastructure market has grown considerably, driven by factors such as economic growth and increasing demand for delivering and upgrading existing infrastructure - with this upward trend expected to continue in line with demand for high quality infrastructure. Against this backdrop of an expanding market, and combined with rising demand for infrastructure as an asset class, the sector is attracting a variety of new investors beyond traditional investors such as operators and construction firms.

It is within this market context that MM Capital Partners launched its infrastructure fund, leveraging the expertise and experience of its three sponsor shareholders. Marubeni has been active in various forms of infrastructure business, on a global basis for many years and has extensive expertise, experience, and local networks in the infrastructure market.

We leverage Marubeni's strengths to source and partner on investment opportunities, and utilise our experience in investing in global infrastructure assets to achieve an appropriate risk assessment and management. In addition, we differentiate ourselves by adding the fund management and infrastructure market experience and knowledge of Mizuho Bank and Asset Management One.

In March 2019, we reached the first close of our “MM Capital Infrastructure Fund I, L.P.” This fund primarily invests in the transportation infrastructure and energy infrastructure sectors and covers operating assets in OECD countries that generate a stable cashflow. In doing so, we aim to mitigate country and project risk while securing stable returns over the investment period. We fully invested all capital having utilised commitments in June 2023, forming a high quality portfolio of eight assets.

In addition, we completed the first close of “MM Capital Infrastructure Fund II, L.P.” in August 2023. This, our second fund provides wide range of investment opportunities including social infrastructure, communications infrastructure and utility infrastructure, in addition to the investment sectors covered by our first fund, “MM Capital Infrastructure Fund I, L.P.”

We will continue managing investment assets in a manner that meets the expectations of our stakeholders, secures stable cashflows and contributes to society through the provision of high quality infrastructure.

Tomohide GotoPresident and CEO

EXECUTIVES

Company Profile

| Company Name | MM Capital Partners Co., Ltd. / MM Capital Partners 2 Co., Ltd. |

|---|---|

| Incorporated | November 1st, 2018 / April 7th, 2023 |

| Representative | President & CEO Tomohide Goto |

| Main Business | Management and Operation of MM Capital Infrastructure Fund |

| Shareholders | Marubeni Corporation (90%), Mizuho Bank Ltd.(5%), and Asset Management One Co., Ltd. (5%) |

| Address | Nihonbashi Takashimaya Mitsui Building 10F, 5-1 Nihonbashi 2 Chome, Chuo-ku, Tokyo, 103-6110, Japan |

| TEL / FAX | TEL:+81-3-5542-1025 FAX:+81-3-5542-1026 |